Here is a unique way to contribute to the financial future of the young ones in your life. Whole life insurance can benefit them and future generations in many ways…

TAX-FREE GROWTH

Cash values grow tax-free and can be accessed to fund future opportunities such as post-secondary education, buying a home, or starting a business.

GUARANTEED INSURABILITY

Regardless of lifestyle or health status their insurability as adults is secured with the ability to obtain $500,000 of additional life insurance.

PERMANENT LEGACY

The initially small whole life insurance death benefit grows over a lifetime to provide financial support for estate and legacy planning.

HOW MUCH IS IT? Plans start at around $21 per month

EXAMPLE:

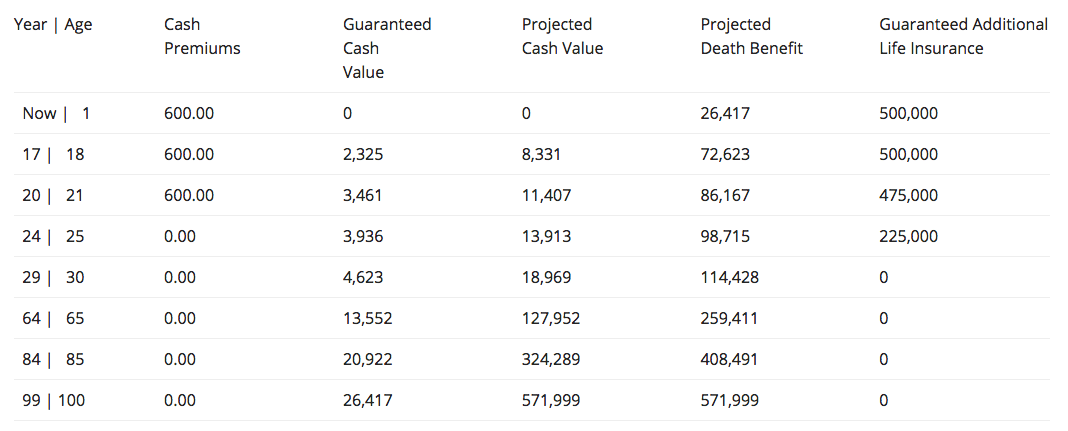

$50 per month set aside for 20 years for the future benefit of a 1 year-old girl.

These policies blossom after the 20-year mark. Here’s how it provides a lifetime of financial benefits:

Age 21: $10,000 of cash value for post-secondary education.

Age 25: $250,000 of additional low-cost term life insurance purchased with no hassle.

Age 30: $17,500 to help with a down payment on a home.

Age 100: A $500,000+ legacy for future generations.

| Year | Age | Cash Premiums | Guaranteed Cash Value | Projected Cash Value | Projected Death Benefit | Guaranteed Additional Life Insurance |

| Now | 1 | 600.00 | 0 | 0 | 26,417 | 500,000 |

| 17 | 18 | 600.00 | 2,325 | 8,331 | 72,623 | 500,000 |

| 20 | 21 | 600.00 | 3,461 | 11,407 | 86,167 | 475,000 |

| 24 | 25 | 0.00 | 3,936 | 13,913 | 98,715 | 225,000 |

| 29 | 30 | 0.00 | 4,623 | 18,969 | 114,428 | 0 |

| 64 | 65 | 0.00 | 13,552 | 127,952 | 259,411 | 0 |

| 84 | 85 | 0.00 | 20,922 | 324,289 | 408,491 | 0 |

| 99 | 100 | 0.00 | 26,417 | 571,999 | 571,999 | 0 |

HOW DO I GET IT?

Applications can be done in-person, online, or over the phone in about 30 minutes.

Get started now by filling out our Insurance Information Form.